45 perpetual zero coupon bond

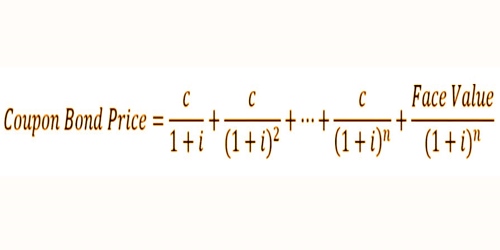

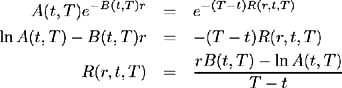

Perpetual futures - Wikipedia In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. . Perpetual futures are cash-settled, and differ from regular futures in that they lack a pre-specified delivery date, and can thus be held indefinitely without the need to roll over contracts as they approach expi Impossible Finance — The Perpetual Zero Coupon Bond The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period. r = discount rate. n = number of periods i.e. infinity. This is a very simple calculation for a Zero Coupon Perpetual bond. The answer is zero because D = 0. Zero divided by anything is zero. Summing up an infinite stream of zeros, strangely enough ...

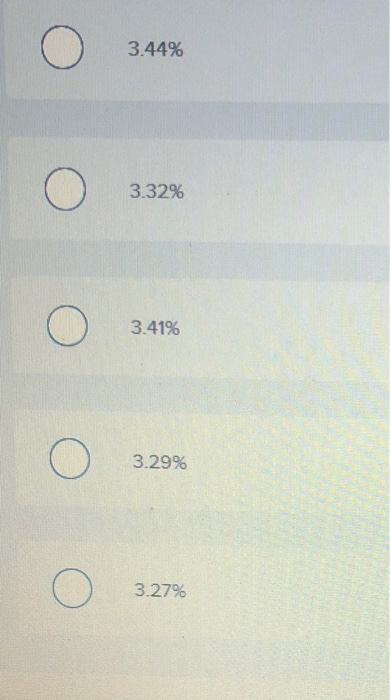

Bitcoin and M1 Inflation - by Stephen Perrenod - Substack Bitcoin or Treasuries or AAA bonds. Furthermore, Bitcoin has no credit risk, as an asset it doesn't go bust, or get downgraded, like corporations can. So it is better than a AAA bond. What do those yield? Currently 2.33% is the AAA corporate yield. Thirty year Zeros are slightly lower than that, and the Treasury long bond with a coupon is ...

Perpetual zero coupon bond

The Crocodile of the Moat: The - GuruFocus.com The closer the float approaches a cost of zero and a duration that approaches infinity, the more it resembles a perpetual zero coupon bond. "Any company's level of profitability is determined by three items: (1) what its assets earn; (2) what its liabilities cost; and (3) its utilization of "leverage" — that is, the degree to ... Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds. About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds (bonds ... US should issue perpetual zero-coupon bonds - Breakingviews Everything you need to empower your workflow and enhance your enterprise data management. Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. Build the strongest argument relying on authoritative content, attorney-editor expertise, and industry defining technology.

Perpetual zero coupon bond. Bonds Home - Morningstar, Inc. Vor 1 Tag · Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information … Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon. Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity …

Crypto: The Giant Ponzi Scam - Medium Bitcoin is a Ponzi scheme, multi-level marketing scheme, and pyramid scheme, all combined into one perpetual zero-coupon bond of societal, monetary, and environmental destruction. Perpetual futures - Wikipedia In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. Perpetual futures are cash-settled, and differ from regular futures in that they lack a pre-specified delivery date, and can thus be held indefinitely without the need to roll over contracts as they approach expiration. Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin T ... Zero-coupon perpetual bonds are not just a theoretical concept. They have been proposed as a practical solution to the problem of government debt. Former US Federal Reserve Chairman, Ben Bernanke, suggested this when he visited Japan in 2016. The idea was for the government of Japan to issue zero-coupon perpetual bonds for the Bank of Japan ... economics - perpetual bond that yields 0% - Personal Finance & Money ... They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share. Improve this answer. Follow answered Mar 6, 2016 at 13:26. mirage007 mirage007. 371 1 1 ...

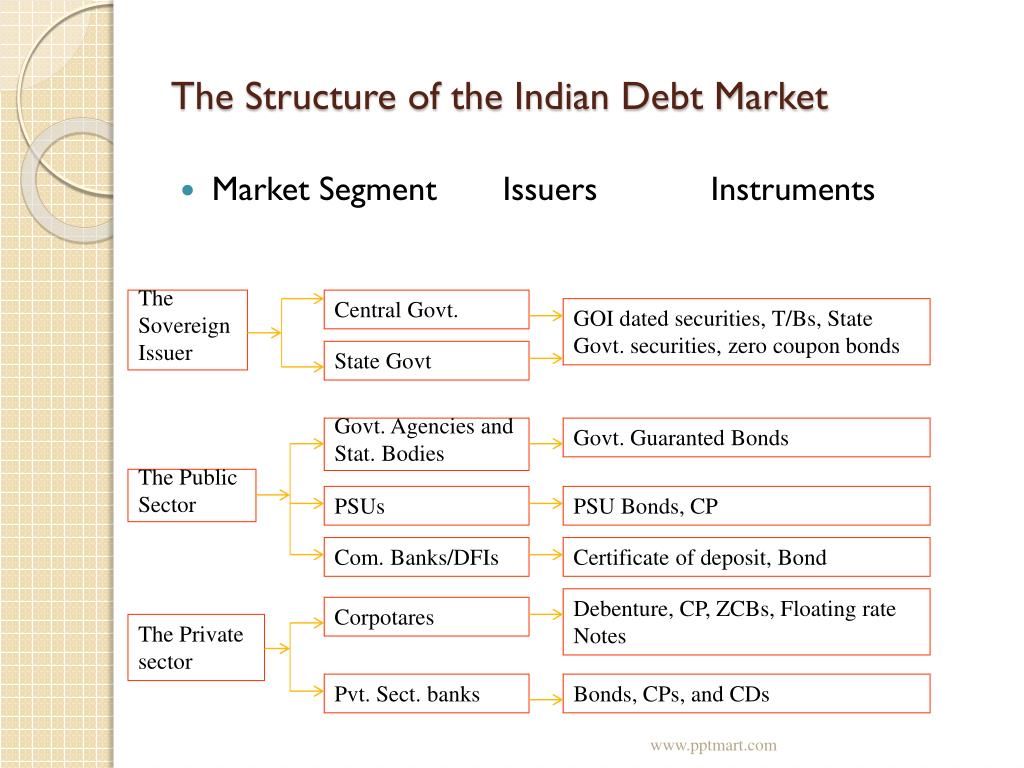

Perpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Bitcoin as a solution for failing monetary system - Medium Bonds currently (2020): 2% coupon against 15% hurdle rate, you lose 13% value every year. ... It's a zero coupon bond that is appreciating. ... Bitcoin is a perpetual honeypot; there is an ... Corporate Bonds India- Invest in Corporate Sector Bonds Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond , others are considered as Non-investment Grade Bond. Coupon rate : Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7%(AAA rated) to 12%(A rated) coupons in the current year 2021. On the contrary, G-secs provide 6% coupon rate. India bonds market data. Government bonds, debt statistics, new bond ... The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ...

The Crocodile of the Moat: Th - GuruFocus.com Get Your 7-Day Free Trial! Start Now! Login

Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha Zero coupon perpetual is sort of a financial oxymoron. This Barron's story notes that some of the conversation around helicopter money in Japan focuses on a zero coupon perpetual bond. Seeking ...

Yield curves - ECB Statistical Data Warehouse - Europa The Yield Curve section provides the results of the daily estimation of euro area government bond yield curves. ... Only fixed coupon bonds with a finite maturity and zero coupon bonds are selected, including STRIPS. Perpetual bonds and variable coupon bonds, including inflation-linked bonds, are not included.

Domestic bonds: India, Bills 0% 11aug2022, INR (91D) IN002022X064 The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ...

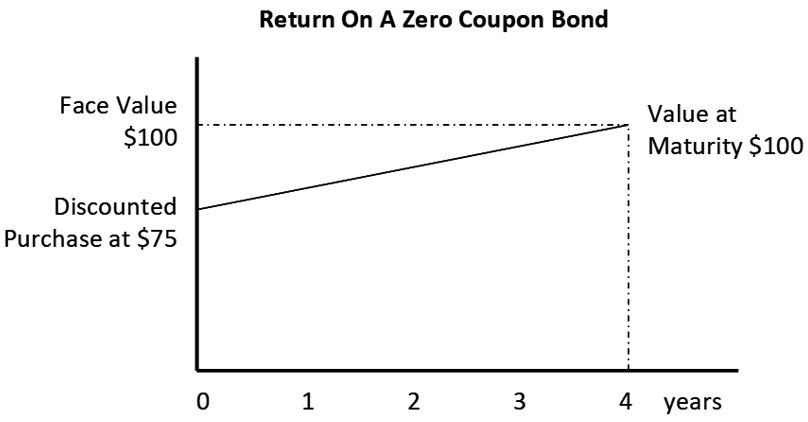

All the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

PDF Boli — an Investment or Life Insurance? - Nfp no stated coupon rate; however, monthly there's a valuation of the asset and income is recognized. It's not a readily marketable asset, but it can be liquidated, subject to consequences. In this sense, BOLI could be defined as a "perpetual zero coupon bond." So with these attributes in mind, do we view BOLI as an investment? We certainly

Secondary Bonds Market – Types of Bonds India You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda Ben S. Bernanke, who met Japanese leaders in Tokyo this week, had floated the idea of perpetual bonds during earlier discussions in Washington with one of Prime Minister Shinzo Abe's key advisers.

perpetual zero bond - LEO: Übersetzung im Englisch ... zero -coupon bond [FINAN.] die Null-Coupon-Anleihe auch: Nullkuponanleihe, Nullkupon-Anleihe Pl.: ...

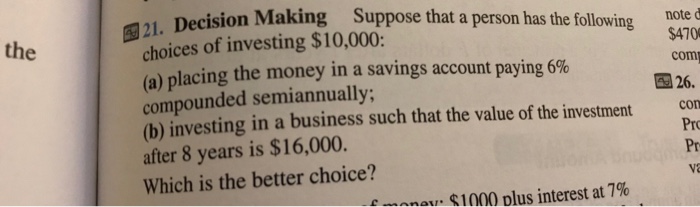

.a. What is the YTM of a perpetual bond with an | Chegg.com .a. What is the YTM of a perpetual bond with an annual coupon of $6 and currently selling at $108? b. Suppose it is a zero-coupon bond with 9 years to maturity and currently selling at 45%, what is its YTM? Question:.a. What is the YTM of a perpetual bond with an annual coupon of $6 and currently selling at $108? b.

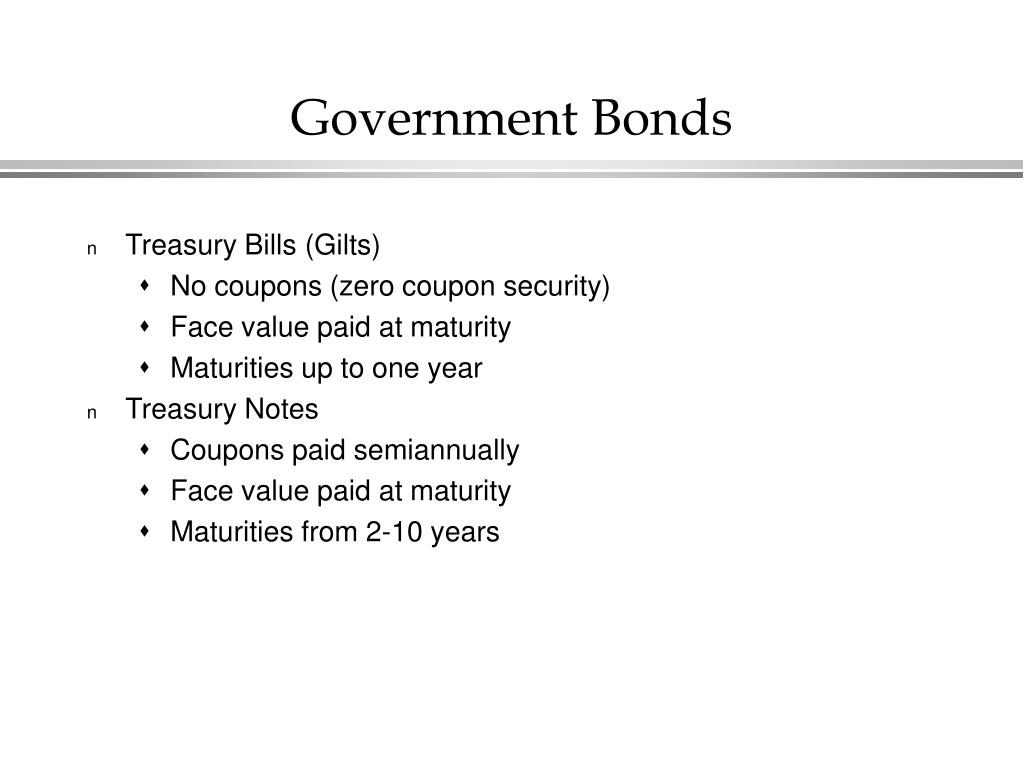

Government bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending.It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would ...

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 ... Perpetual zero-coupon bonds are essentially worthless, which means the BOJ cannot sell them—no one in the private sector would be stupid enough to buy them. That means the only way to mop up the excess reserves created via the issue of perpetual zero-coupon bonds is for the BOJ to ask the MOF to issue equivalent amounts of coupon-bearing ...

Perpetual Bond Definition - Investopedia 19.03.2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

Perpetual Zero Bond • Definition | Gabler Banklexikon Lexikon Online ᐅPerpetual Zero Bond: scherzhaft für zweifelhafte Qualität oder sehr schlechtes Rating eines Emittenten. Weder Zins- noch Kapitalrückzahlung ...

An Overview of Perpetual Bonds - Investopedia The price of a perpetual bond is, therefore, the fixed interest payment, or coupon amount, divided by the discount rate, with the discount rate representing the speed at which money loses value ...

Secondary Bonds Market – Types of Bonds India You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

Bond (finance) - Wikipedia Perpetual bonds are also often called perpetuities or 'Perps'. They have no maturity date. ... An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the ...

Post a Comment for "45 perpetual zero coupon bond"