43 how to find the coupon rate of a bond

A company issues a ten-year bond at par with a coupon rate ... A company issues a ten-year bond at par with a coupon rate of 6% paid semi-annually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 7.8%. What was the percentage change in the price of the bond over the past two years? Calculate your paper price. What Is the Coupon Rate of a Bond? Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

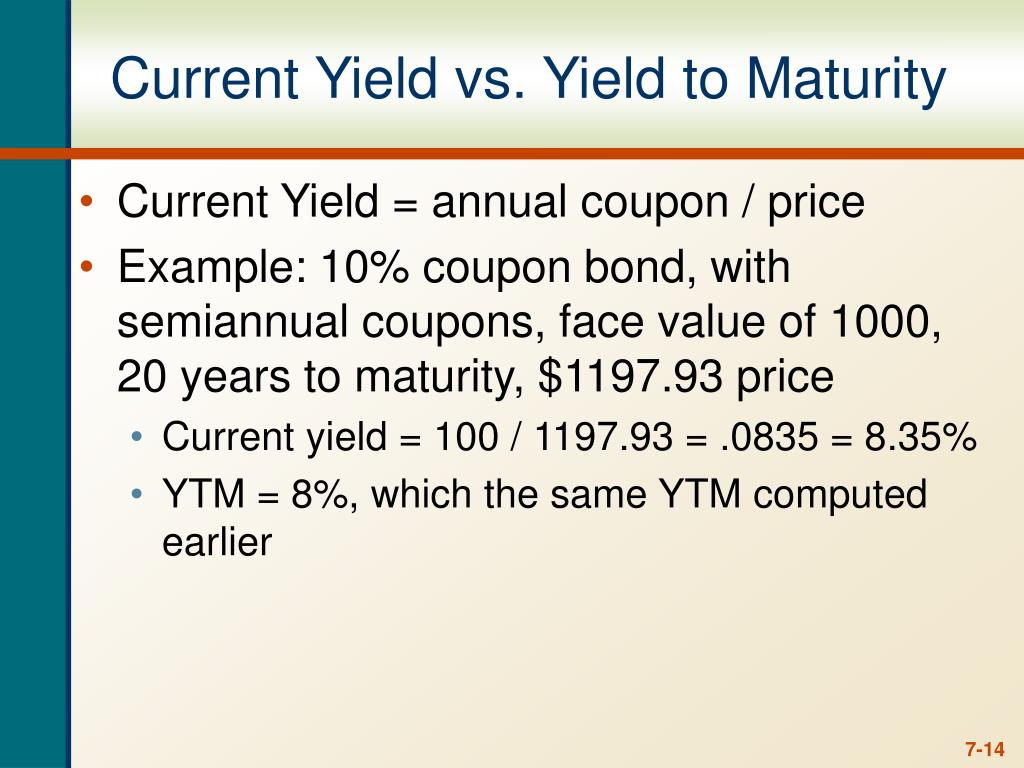

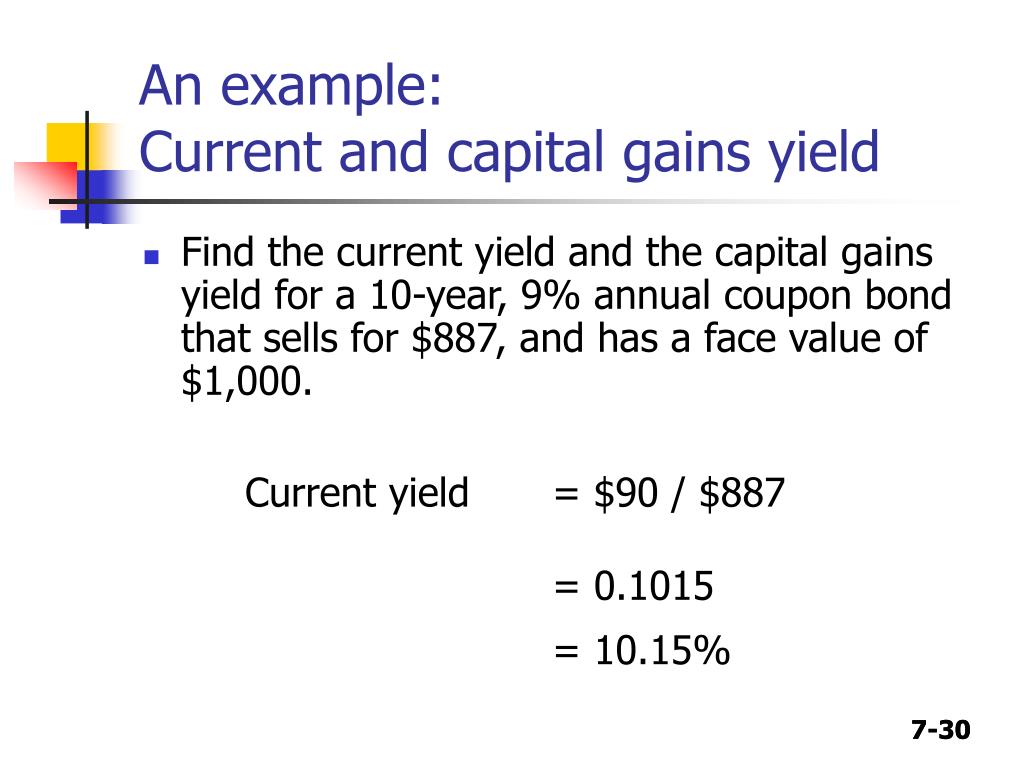

How do you calculate the PMT of a bond? - FindAnyAnswer.com Multiply the bond's coupon rate by its par value to determine its annual interest. In this example, multiply 5 percent, or 0.05, by $1,000 to get $50 in annual interest. Divide the bond's annual interest by its priceto convertthe priceto a yield. In this example, divide $50 by $1,048.90 to get 0.0477.

How to find the coupon rate of a bond

How to Calculate Coupon Rates - sapling To calculate bond coupon rates, use the formula C = i/P, where "C" represents the coupon rate, "i" represents the annualized interest rate and "P" represents the par value, which is the principal amount (or face value) of the bond. The coupon rate is based on a bond's face value, not current yield. Bond Price Calculator n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond. Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. that includes attached coupons and pays periodic (typically ...

How to find the coupon rate of a bond. Coupon Rate Calculator | Bond Coupon The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 What Is a Coupon Rate? How To Calculate Them & What They ... Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. Create function in R to find coupon rate for bond Bookmark this question. Show activity on this post. So far, I have written the following function: c_rate <- function (bond_value, par, ttm, y) { t <- seq (1, ttm, 1) pv_factor <- 1 / (1 + y)^t cr <- (bond_value - par / (1+y)^t) / (par*sum (pv_factor)) cr } however, this yields multiple results. How can i update the function to only yield one ...

Business Finance Ch. 6 Flashcards - Quizlet If a firm raises capital by selling new bonds, it could be callable the "bond holders," and the coupon rate is generally set equal to the required rate on bonds of equal risk. 2 answers. QUESTION. the specified date on which the principal amount of a bond is repaid is called the bonds. 8 answers. QUESTION. What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, determine the interest payment for the following three bonds And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Advertisement Expert-verified answer abiolataiwo2015 In our example, How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

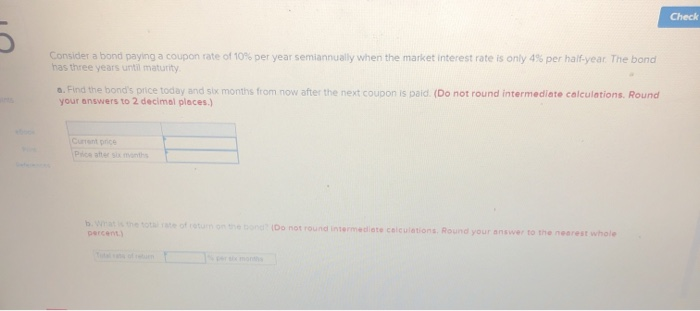

[Solved] Consider a bond paying a coupon rate of 10% per year semiannually when the market ...

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

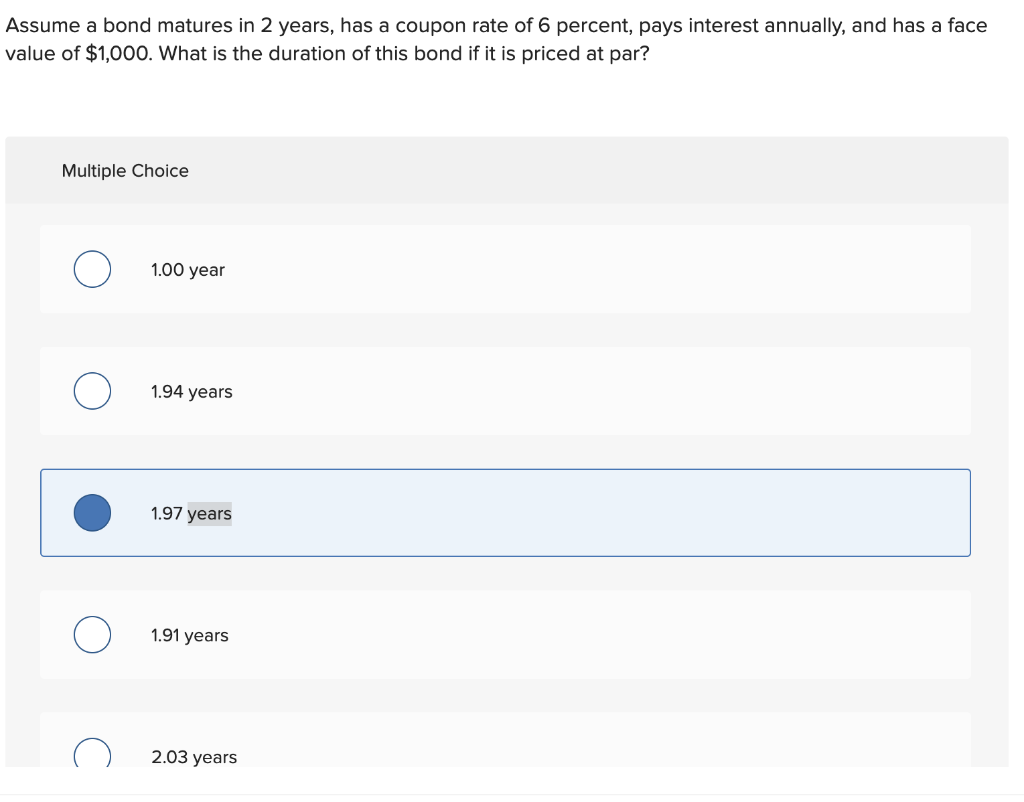

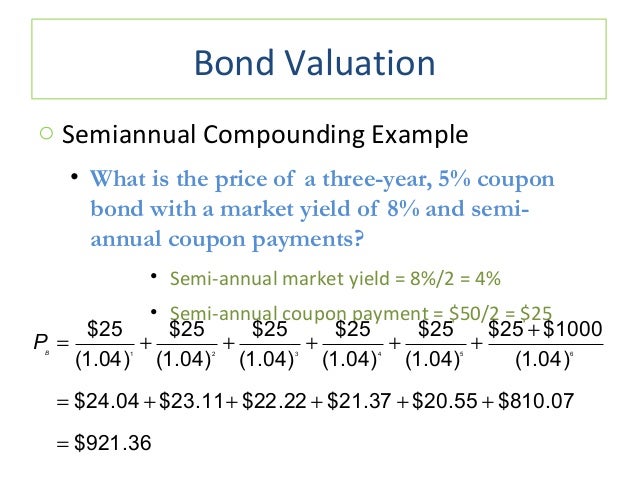

How to Calculate the Bond Duration (example included ... PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

Coupon Rate Formula - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. This calculation is I, the periodic interest paid. For example, if the bond pays interest semiannually, I = $30 per period. Each period is 6 months. Determine ...

Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

how to calculate coupon rate - OpenTuition Year 1= 3.85%, year 2 = 4.46%, yr 3 = 5.07, yr 4 = 5.8,yr 5 = 6.12. The directors are considering the two following option, 1) issue the new bond at fixed coupon of 5% but at a premium or discount whichever is appropriate. 2) issue the bond at a coupon rate where the issue price of new bond will be 100 per unit and equal to its par value.

Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

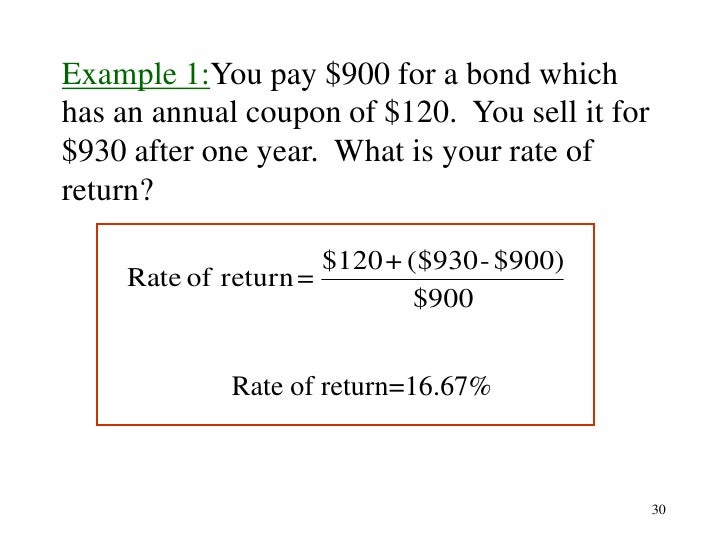

Bond Yield to Maturity (YTM) Calculator - DQYDJ How did we find that answer? We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n

10. A three-year bond has 8.0% coupon rate and face ... A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes annual coupon Interest payments. a b. $ 950.26 C. $1,051.54

Floating Rate Bonds: Characteristics, Rate, and Important ... Fixed-rate bonds lose the charm for investors when interest rates rise, as the investors can purchase another bond with higher coupon rates. Floating-rate bonds eliminate that factor of uncertainty for investors. As the coupon payments adjust with interest rate changes, the investors are less exposed to the opportunity cost. ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond. Bonds Bonds are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. that includes attached coupons and pays periodic (typically ...

Bond Price Calculator n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

How to Calculate Coupon Rates - sapling To calculate bond coupon rates, use the formula C = i/P, where "C" represents the coupon rate, "i" represents the annualized interest rate and "P" represents the par value, which is the principal amount (or face value) of the bond. The coupon rate is based on a bond's face value, not current yield.

Post a Comment for "43 how to find the coupon rate of a bond"