38 find the face value of the zero coupon bond

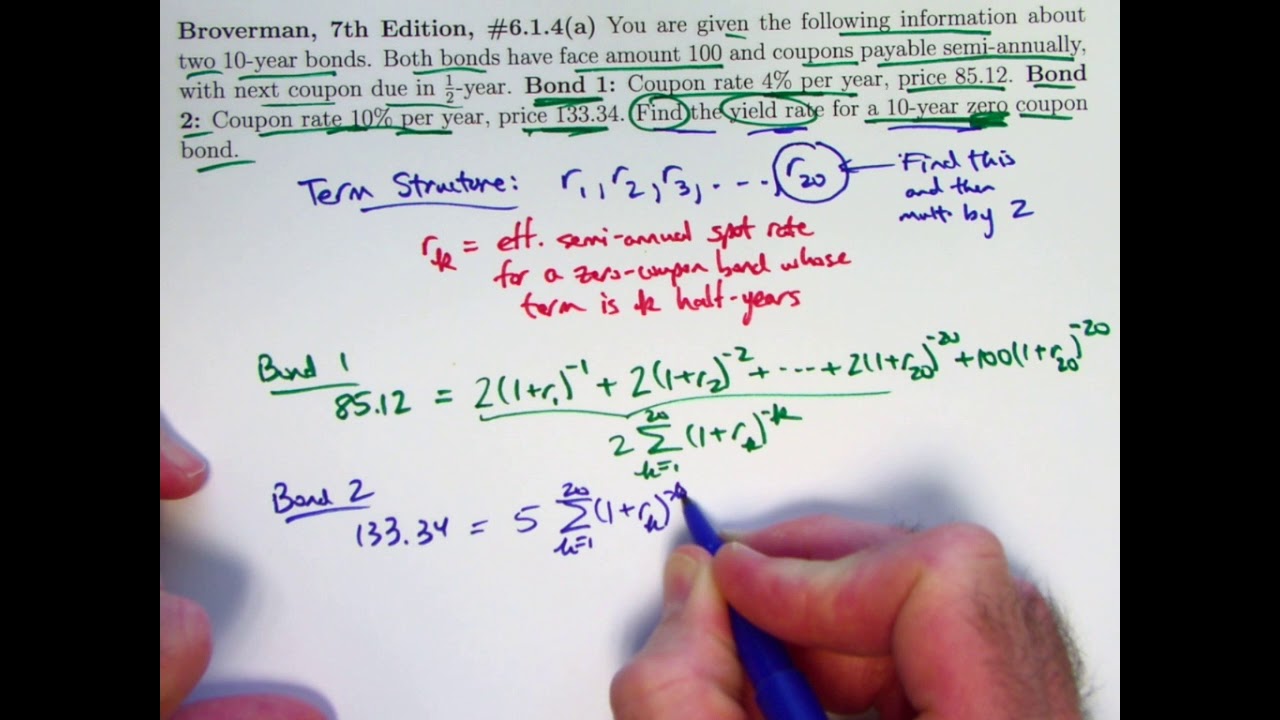

Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

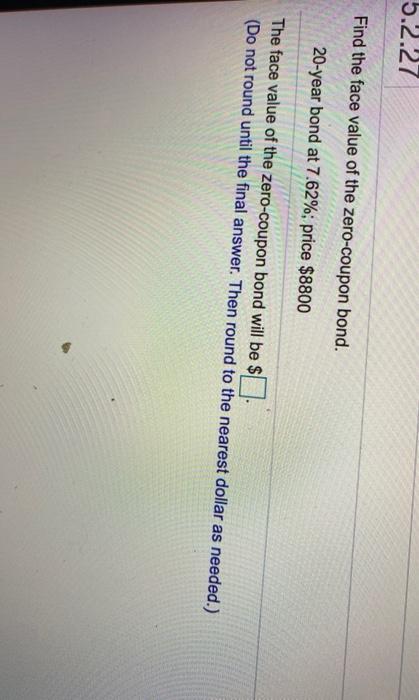

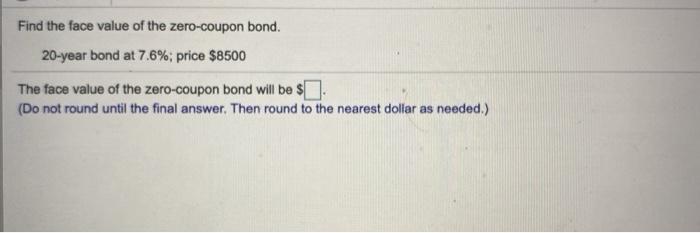

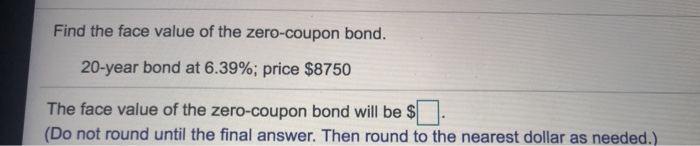

Find the face value of the zero coupon bond

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

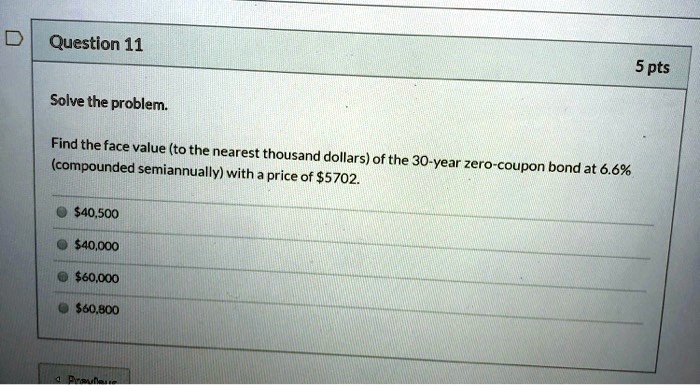

Find the face value of the zero coupon bond. [Solved]: If Cheri buys a zero coupon bond at \( \$ 5000 \) If Cheri buys a zero coupon bond at \( \$ 5000 \) and the face value amount is stated as \( \$ 10,000 \), how much will she receive when the bond mat... | solutionspile.com ... Expert Answers / Finance / if-cheri-buys-a-zero-coupon-bond-at-5000-and-the-face-value-amount-is-stated-as-10--pa964 (Solved): If Cheri buys a zero coupon bond at ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. Answered: A zero coupon bond with a face value of… | bartleby Thatcher Corporations bonds will mature in 10 years. The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050. Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity

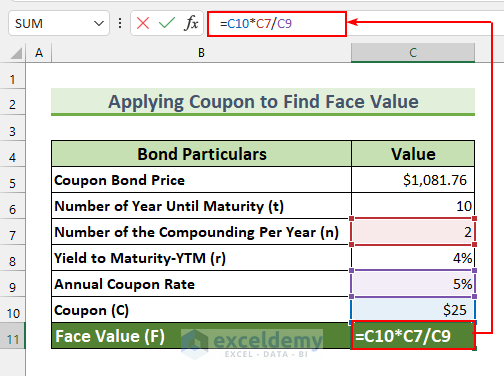

What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until... Solved Find the face value of the zero-coupon bond. 20-year | Chegg.com Question: Find the face value of the zero-coupon bond. 20-year bond at \ ( 8.48 \% \) (compounded semiannually), price \ ( \$ 9550 \) The face value of the zero-coupon bond will be ? (Round to the nearest dollar as needed.) This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. 1. Consider a zero-coupon bond with a $1,000 face value and 15... Answered step-by-step. 1. Consider a zero-coupon bond with a $1,000 face value and 15... 1. Consider a zero-coupon bond with a $1,000 face value and 15 years to maturity. The price will this bond trade if the YTM is 7.3 % is closest to: 2. What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a ... Zero Coupon Bond Calculator - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

SOLVED: Find the face value of the zero-coupon bond: 20-year bond at 6. ... Find the face value of the zero-coupon bond: 20-year bond at 6.34%; price 59550 The face value of the zero-coupon bond will be (Do not round until the final answer: Then round to the nearest dollar as needed ) › Calculate-Bond-ValueHow to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. If a zero coupon bond with a face value of 2000 and View full document. 5. If a zero-coupon bond with a face value of $2000 and 10 years left until maturity is currently being traded for $1200, what is the yield to maturity of this bond? A. 1.15% B. 2.58% C. 5.77%D. 10.23% E. 5.24% 6. Harden Corporation offers 20-year, 9% semiannual coupon bonds with a par value of $1,000 and a yield to. Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Enter the face value of all post-1989 paper Series EE bonds cashed in 2021 _____ 3. Multiply line 2 by 50% (0.50) _____ 4. Enter the face value of all electronic Series EE bonds (including post-1989 Series EE bonds converted from paper to electronic format) and all Series I bonds cashed in 2021 _____ 5. Add lines 3 and 4 _____ 6. Subtract line ...

Chapter 6 Bonds Tutorial Solution.xlsx - A) CPN = (Coupon... The three-year zero-coupon bond will have the h d sooner and the longer the time to maturity, the less the PV o you would divide/discount the Face value by a higher amount bond with a face value of $100 with a yield to maturiy of 5%. d = 86.38=100/(1+0.05)^3 = 78.35=100/(1+0.05)^5 e by (1+0.05)^3 which is a smaller value than (1+0.05)^5 whic ee ...

smartasset.com › investing › face-value-of-a-bondWhat Is the Face Value of a Bond? - SmartAsset Sep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

Solved Find the face value of the zero-coupon bond. 15-year | Chegg.com Find the face value of the zero-coupon bond. 15-year bond at 3.3%; price $3000 The face value will be $. (Do not round until the final answer. Then round to the nearest dollar as needed.) A six-month $4800 treasury bill sold for $4562. What was the simple annual discount rate? The discount rate was %.

› fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

› stories › memberpageLiterotica.com - Members - SZENSEI - Submissions Mar 08, 2017 · Mountain climbing just to find a Rose. Petals will fall! Exhibitionist & Voyeur 04/10/22: Cougar House Ep. 045: TURNING poINt (4.80) Early to bed, early to rise, that's the problem with all horny guys. Exhibitionist & Voyeur 04/17/22: Cougar House Ep. 046: Peak Performance (4.76) She'll be cumming on the mountain. She'll be cumming on the mountain.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

Zero Coupon Bond Calculator - What is the Market Value? The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

› bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Post a Comment for "38 find the face value of the zero coupon bond"